About

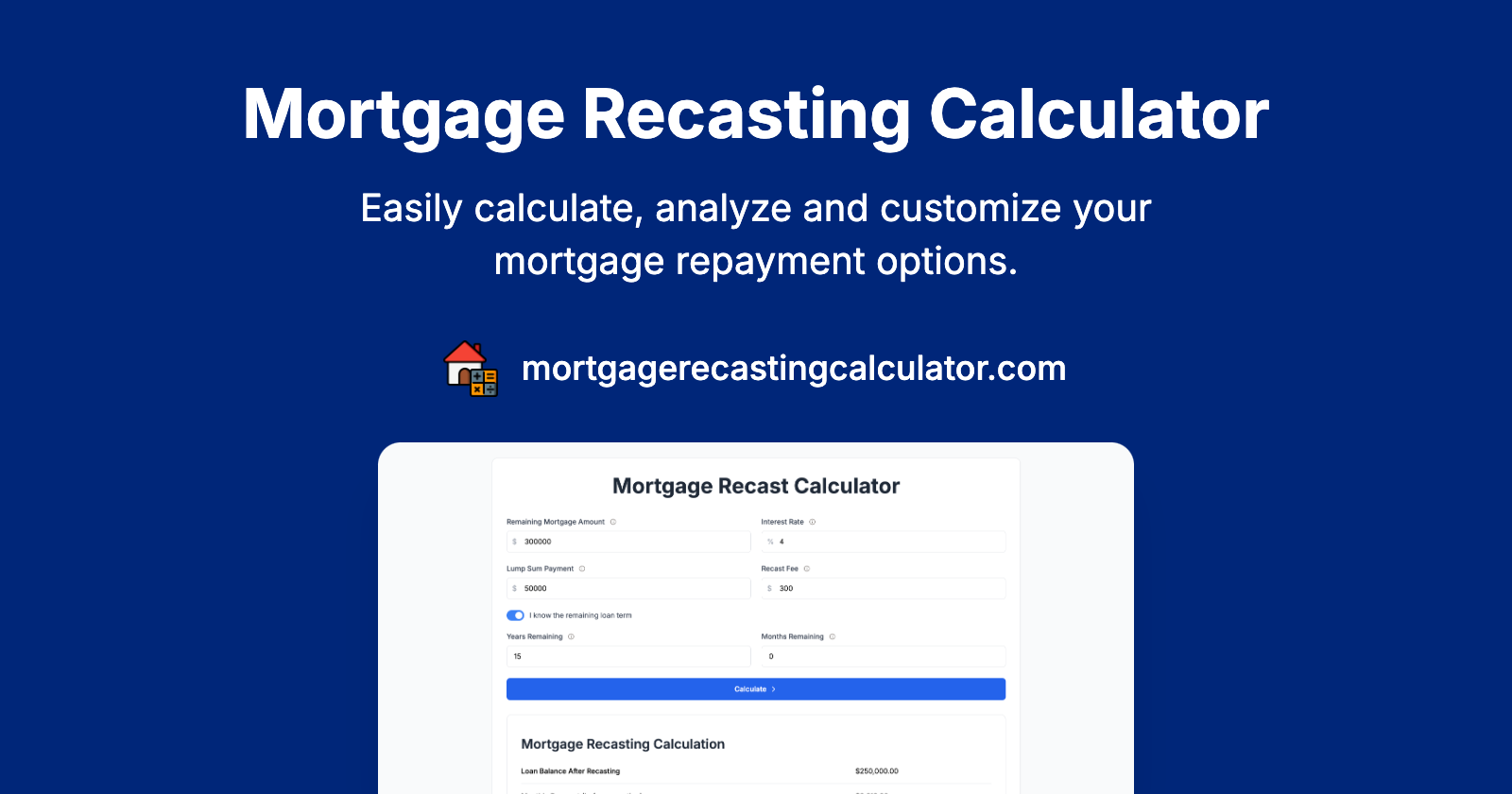

The Mortgage Recast Calculator is a valuable tool for homeowners looking to re-amortize their loan and estimate savings and new payments when recasting their home mortgage. This tool is particularly helpful for individuals with conventional mortgages who want to lower their monthly payments without refinancing. By using the calculator, users can make informed decisions about their mortgage and potentially save thousands of dollars in interest payments.

Details

The Mortgage Recast Calculator takes into account the following features:

- Remaining Mortgage Amount: The current balance of the mortgage

- Interest Rate: The annual interest rate applied to the mortgage

- Lump Sum Payment: The extra payment made to recast the mortgage

- Recast Fee: The fee charged by the lender for recasting, typically between $250 and $500

- Remaining Loan Term: The number of full years and additional months left on the mortgage term

The calculator also provides information on:

- How mortgage recasting works and its benefits

- The differences between mortgage recasting and refinancing

- Eligibility criteria for mortgage recasting, including holding a conventional loan, having a significant lump sum available, and maintaining a good payment history

- The best time to recast a mortgage, such as when interest rates are high or after receiving a large sum